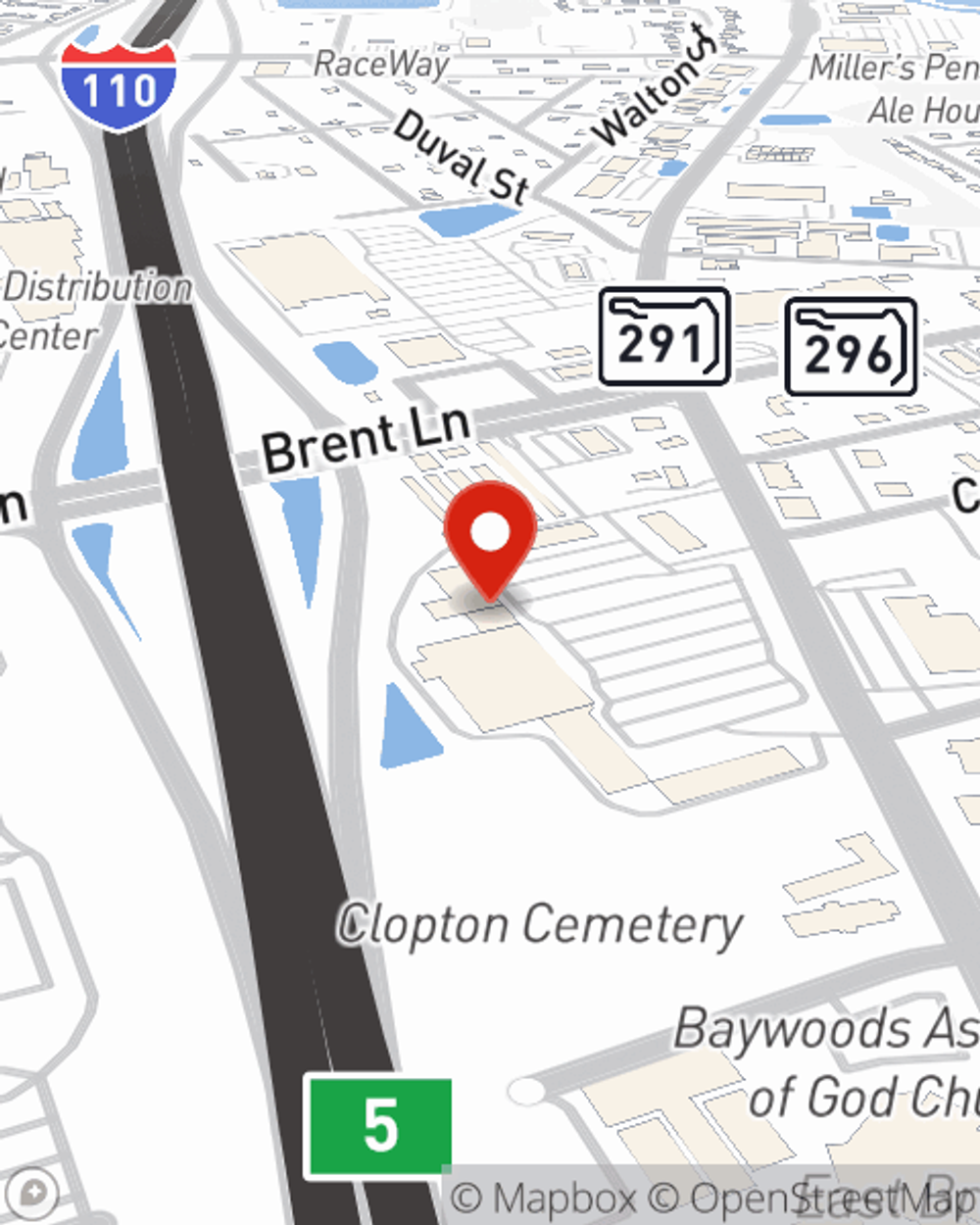

Business Insurance in and around Pensacola

One of the top small business insurance companies in Pensacola, and beyond.

No funny business here

Help Prepare Your Business For The Unexpected.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including errors and omissions liability, worker's compensation for your employees and extra liability coverage, among others.

One of the top small business insurance companies in Pensacola, and beyond.

No funny business here

Protect Your Future With State Farm

Your company is one of a kind. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or a facility. Your business is your life's work. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a hair stylist. State Farm agent Chris Proctor is ready to help review coverages that fit your business needs. Whether you are an HVAC contractor, a podiatrist or a physician, or your business is a refreshment stand, a pizza parlor or a shoe repair shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Chris Proctor understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Contact agent Chris Proctor to talk through your small business coverage options today.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Chris Proctor

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.